Politics, Environment, Current Events and Cinema----------------------------------------CLICK ON ANY IMAGE TO ENLARGE !!!!!!!!!!!!

Thursday, February 01, 2007

Friday, January 26, 2007

Tuesday, January 23, 2007

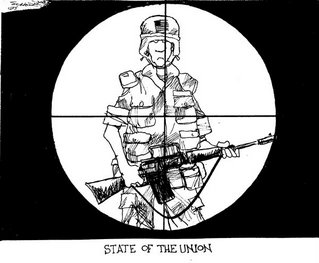

JON STEWART PREVIEW BUSH'S STATE OF THE UNION SPEECH -- VIDEO

Tuesday, January 16, 2007

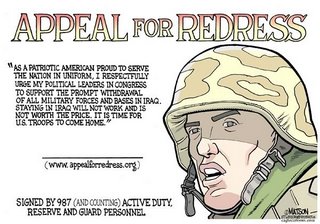

FIFTY ACTIVE DUTY OFFICERS DELIVER IRAQ PULLOUT PETITION TO CONGRESS

Saturday, January 13, 2007

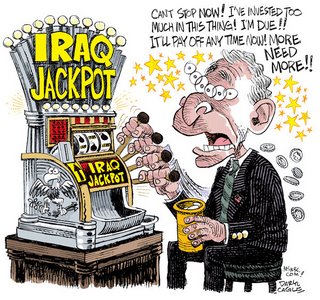

KEITH OLBERMANN NAILS IT AGAIN -- ANALYSIS OF BUSH'S SPEECH

Friday, January 12, 2007

Tuesday, January 09, 2007

Saturday, January 06, 2007

Tuesday, January 02, 2007

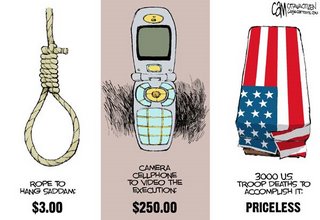

POLL SHOWS TROOPS ARE MOSTLY AGAINST BUSH'S HANDLING OF WAR

Saturday, December 30, 2006

Thursday, December 28, 2006

UNITED ARAB EMIRATES TO SELL DOLLARS FOR EUROS

The United Arab Emirates plans to convert 8 percent of its foreign-exchange reserves to euros from dollars before September, the latest sign of growing global disaffection with the weakening U.S. currency.

The U.A.E. has started, "in a limited way," to sell part of its dollar reserves, the governor of the country's central bank, Sultan Bin Nasser al-Suwaidi, said in an interview. "We will accumulate euros each time the market appears to dip" as part of a plan to expand the country's holding of euros to 10 percent of the total from the current 2 percent.

The Gulf state is among oil producers, including Iran, Venezuela and Indonesia, looking to shift their currency reserves into euros or sell their oil, which is now priced in dollars, for euros. The total value of the reserves held by the U.A.E. is $24.9 billion, Suwaidi said.

The dollar has fallen more than 10 percent this year against the euro.

Part of the reason for the decline is the outlook for slower U.S. growth, which makes the dollar a less attractive investment.

But fears that the dollar's level is unsustainable because of the heavy indebtedness of the United States to other countries is also behind the weakness this year, analysts said. Read on…

The U.A.E. has started, "in a limited way," to sell part of its dollar reserves, the governor of the country's central bank, Sultan Bin Nasser al-Suwaidi, said in an interview. "We will accumulate euros each time the market appears to dip" as part of a plan to expand the country's holding of euros to 10 percent of the total from the current 2 percent.

The Gulf state is among oil producers, including Iran, Venezuela and Indonesia, looking to shift their currency reserves into euros or sell their oil, which is now priced in dollars, for euros. The total value of the reserves held by the U.A.E. is $24.9 billion, Suwaidi said.

The dollar has fallen more than 10 percent this year against the euro.

Part of the reason for the decline is the outlook for slower U.S. growth, which makes the dollar a less attractive investment.

But fears that the dollar's level is unsustainable because of the heavy indebtedness of the United States to other countries is also behind the weakness this year, analysts said. Read on…

Monday, December 25, 2006

GLOBAL WARMING WIPES INHABITED ISLAND OFF THE FACE OF THE EARTH

Friday, December 22, 2006

Monday, December 18, 2006

Wednesday, December 06, 2006

GORE; IRAQ IS WORST STRATEGY MISTAKE IN U.S. HISTORY

Monday, December 04, 2006

Friday, December 01, 2006

Subscribe to:

Posts (Atom)